Electric Truck Market Share, Growth & Trends Report 2025-2033

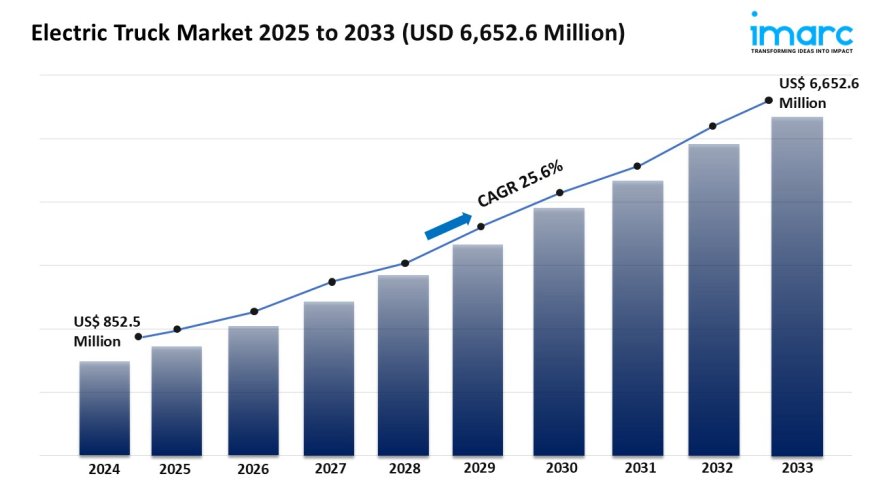

The global market size was valued at USD 852.5 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 6,652.6 Million by 2033, exhibiting a CAGR of 25.6% from 2025-2033.

Market Overview:

The electric truck market is experiencing rapid growth, driven by government incentives and regulations, advancements in battery technology, and rising demand for sustainable logistics. According to IMARC Group's latest research publication, "Electric Truck Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion, Range, Application, and Region, 2025-2033", offers a comprehensive analysis of the industry, which comprises insights on the global electric truck market share. the global market size was valued at USD 852.5 Millionin 2024. Looking forward, IMARC Group estimates the market to reachUSD 6,652.6 Millionby 2033, exhibiting aCAGR of 25.6%from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/electric-truck-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Electric Truck Market

- Government Incentives and Regulations

Government policies are a major factor impacting the growth of the electric truck market. All around the world, companies offer varying forms of incentives like tax credits, rebates, and grants for adopting EVs and trucks. The U.S. Inflation Reduction Act explains how tax credits can be provided to commercial electric vehicles; and it makes electric trucks more viable for fleet managers and operators. In addition to incentives, heavy-duty vehicle manufacturers are also responding to stringent emission regulatory policies. For example, the European Union's CO2 standards for heavy-duty vehicles are creating pressure for manufacturers to create electric options. In summary, regulatory incentives reduce the up-front cost of electric trucks, while expanding the growing opportunities for alignment with international sustainability objectives and goals; and it further encourages manufacturers like Volvo, Daimler, and Ford to invest billions of dollars into electric trucks. Ultimately, regulatory policy supports market growth that help lessen the cost burdens of electric trucks, while simultaneously aiding logistic decisions toward green alternatives.

- Advancements in Battery Technology

Advancements in battery technology are also driving the electric truck market by alleviating range and payload concerns. Current lithium-ion batteries have higher energy densities, enabling trucks to travel further and recharge faster. For example, Tesla's Semi truck can travel 500 miles with one charge to be suited for long-haul logistic transport. More innovations are emerging, including the possibility of solid-state batteries, which are far future potential options as companies like Toyota invest in solid-state technology. This will reduce downtime- charging- and will ultimately improve efficiency, which is beneficial for logistics companies. As battery costs decrease while performance improves, and range grows larger, adoption rates will rise substantially.

- Rising Demand for Sustainable Logistics

Sustainability in supply chains is increasing in importance. Companies are coming under more pressure from consumers and other stakeholders to reduce carbon footprints. Electric trucks offer zero tailpipe emissions. Take Amazon, for instance; Amazon has pledged to deploy 100,000 electric delivery vans from Rivian by 2030 to support its net-zero carbon commitment. This commitment is encouraging in a world in which e-commerce has exploded, particularly in the urban delivery sector since electric trucks reduce noise pollution as well as air pollution. With growth in e-commerce, companies are making electric fleets a high priority in developing plans to achieve sustainability targets, thus increasing demand among manufacturers. The hope is that companies will continue to expand electric truck offerings to help support their chance of success.

Key Trends in the Electric Truck Market

- Expansion of Charging Infrastructure

Expanding the charging infrastructure is a significant trend influencing the electric truck market. High-power charging stations for heavy-duty vehicles are being developed specifically for fleet applications. For example, Daimler Truck has partnered with BlackRock to develop a network of 700 charging points throughout Europe by 2030. These charging stations are designed to meet the high energy needs of an electric truck and alleviate range anxiety with long-haul contractors. In addition to high-power charging stations dedicated to electric trucks, funding for public charging networks is being advanced by governments. The U.S. National Electric Vehicle Infrastructure program is example government program supporting commercial electric vehicle charging. These developments support the feasibility of electric trucks and enhance adoption across multiple transport sectors.

- Integration of Autonomous Technologies

The incorporation of autonomous driving technologies into electric trucks is reshaping the truck market. Thanks to new features like advanced driver-assistance systems (ADAS) and full autonomy, the potential for operational improvements and enhanced safety is promising. Take the case of Einride, the Swedish company that integrates autonomous electric trucks into freight transport. This development reduces the cost of labor and enables better optimization of the route. These autonomous technologies would rely on the electric truck's digitalized architecture to work under the conditions of freight transport. Electric trucks contain digital architectures that are easier to match with autonomous driving technologies than traditional diesel trucks. Companies like Waymo and TuSimple continue moving toward the ultimate goal of autonomous trucks. If successful, autonomous electric trucks will not only help streamline logistics, but also reduce costs and help accelerate the shift to electric fleets.

- Fleet Electrification by Major Corporations

The trend of fleet electrification is being forced upon us by large corporations, thereby having an influence on the electric truck market. Organizations such as Walmart and UPS are putting electric fleets on the road to satisfy sustainability goals and to reduce costs. For example, during the 2020-21 timeframe, UPS signaled their intentions to transition their fleet to an all-electric model with the announcement of an order of 10,000 electric delivery vans to be delivered by Arrival, a United Kingdom-based van manufacturer. It would simply >make sense to transition from a fleet of approximately 125,000 vans and trucks to a mobile fleet of switched electric power. In addition to sustainable goals, large fleet operators see electric trucks as operators of reduced maintenance cost structures and as a benefit to the initial early adopters. These corporate operators are producing sustainability targets, creating the critical mass of EV trucks to build market saturation, as well as spurring other smaller operators and suppliers to implement EV trucks and electrification plans for smaller operations.

Leading Companies Operating in the Global Electric Truck Industry:

- VolvoGroup

- BYD Company Ltd.

- Mercedes-Benz Group AG

- China FAW Group Co. Ltd.

- Isuzu Motors Ltd.

- Navistar Inc.

- PACCAR Inc.

- Rivian Automotive Inc.

- Volkswagen AG

- Tata Motors Limited

- Tesla Inc.

- Tevva Motors Limited

Electric Truck Market Report Segmentation:

By Vehicle Type:

- Light-duty Truck

- Medium-duty Truck

- Heavy-duty Truck

Light-duty trucks dominate the market in 2024 with approximately 63.8% share, favored for urban deliveries due to their zero emissions, lower operating costs, and maneuverability.

By Propulsion:

- Battery Electric Truck

- Hybrid Electric Truck

- Plug-in Hybrid Electric Truck

- Fuel Cell Electric Truck

Hybrid electric trucks lead the market by combining an internal combustion engine with electric propulsion, enhancing fuel efficiency and reducing emissions while maintaining long-distance capability.

By Range:

- 0-150 Miles

- 151-300 Miles

- Above 300 Miles

The 0-150 miles range category is the market leader, ideal for urban deliveries and short-haul transportation, offering zero emissions and compliance with stringent urban regulations.

By Application:

- Logistics

- Municipal

- Construction

- Mining

- Others

Logistics holds a 38.7% market share in 2024, with electric trucks preferred for urban deliveries, driven by sustainability trends and supported by improved charging infrastructure.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America represents over 37.8% of the market in 2024, bolstered by advanced EV charging infrastructure, government investments, and favorable regulatory incentives for electric truck adoption.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145