Swinging into the Future: Exploring the Growth of the Golf Course Operation Service Market

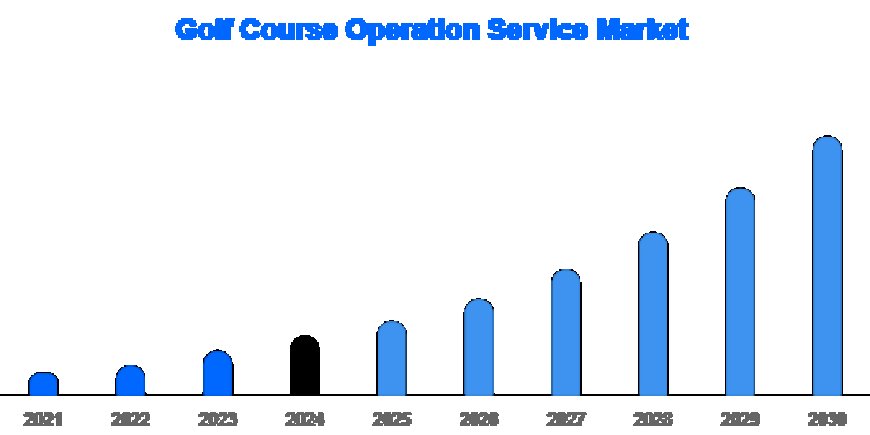

The global golf course operation service market size was valued at USD 25.6 billion in 2024 and is projected to grow from USD 26.7 billion in 2025 to USD 33.34 billion by 2030

Market Overview

The globalgolf course operation service marketwhich includes services such as turf maintenance, clubhouse operations, pro shop management, food and beverage handling, and event hosting has experienced steady growth in recent years. The market was valued betweenUSD25.6billion in 2024and is projected to reach aroundUSD33.34billion by 2030, with a compound annual growth rate (CAGR) of 4.5%.

Key growth drivers include rising participation in golf, growing interest from younger demographics, increased tourism activities related to golf, and expanding disposable incomes, particularly in developing nations.

Latest Trends

Technology Integration

Golf courses are embracing technology to improve both operations and customer experience. This includes smart irrigation systems, GPS-enabled carts, automated tee time booking platforms, and AI-driven turf maintenance solutions. These innovations enhance efficiency and reduce costs.

Rise of Entertainment-Based Golf

The concept of golf entertainment is trending, blending traditional golf with social and digital experiences. Facilities are being designed to offer food, music, lounges, and ball-tracking simulators that appeal to casual players, especially the younger generation.

Sustainability Focus

Environmental responsibility is now a priority. Operators are investing in water-saving systems, eco-friendly fertilizers, and renewable energy. These efforts not only reduce costs but also align with regulatory requirements and public expectations for sustainability.

Labor Optimization

Due to growing challenges in hiring and retaining skilled labor, operators are adopting workforce management systems, offering training programs, and enhancing employee benefits to maintain operational excellence.

Market Challenges

High Operating and Capital Costs

Running a golf course requires significant financial investment. From initial land acquisition and design to ongoing maintenance, the costs can be substantial. Many courses struggle to balance premium experiences with profitability.

Economic Instability

Golf is often considered a luxury activity. Economic downturns or inflationary pressures tend to impact discretionary spending, affecting membership renewals and pay-per-play revenues.

Environmental Regulations

As water and pesticide usage become more heavily regulated, operators must adopt sustainable practices. These requirements can be costly and require operational adjustments, particularly in arid or drought-prone regions.

Labor Shortages

The industry faces persistent workforce challenges, including a shortage of trained greenskeepers, hospitality staff, and seasonal workers. This can compromise service quality and increase operational strain.

Market Opportunities

Hybrid & Multi-use Facilities

There is rising demand for multi-functional spaces that blend traditional golf with entertainment, dining, and event hosting. These hybrid facilities can increase revenue streams and attract a broader customer base.

Sustainable Certifications

Courses that adopt green certifications and promote eco-friendliness are gaining attention. These credentials can attract environmentally conscious golfers and corporate clients.

Expansion in Emerging Markets

Regions such as Asia-Pacific and Latin America present vast opportunities for new golf courses and service providers, thanks to increasing urbanization and economic growth.

Golf Tourism Growth

The growing popularity of golf vacations and international tournaments creates demand for full-service operations, including accommodations, pro shops, and event management services.

Segment Overview: ABC

By Service Type

-

Course Maintenance: Includes landscaping, turf care, irrigation, and equipment upkeep.

-

Event Hosting & Management: Organizing tournaments, social events, and golf leagues.

-

Clubhouse Operations: Management of locker rooms, lounges, and reception areas.

-

Food & Beverage: Catering, bar services, and on-course refreshments.

By Facility Type

-

Public Courses: Open to the public and typically funded by local governments.

-

Private Clubs: Operated through memberships, offering exclusive services.

-

Resort Courses: Integrated into luxury hotel/resort environments.

-

Municipal Courses: Community-operated and budget-sensitive.

-

Executive Courses: Smaller, shorter layouts catering to casual or time-conscious golfers.

By End-User

-

Club Owners: Private businesses focusing on premium experiences.

-

Government Bodies: Aim for accessibility and sustainability.

-

Franchise Chains: Operate multiple locations with standardized service models.

-

Golf Tourism Operators: Focused on vacationers and event participants.

Top Players: Recent Developments and Deals

Key Companies

Leading players in the golf course operation service market include:

-

Troon

-

KemperSports

-

Arcis Golf

-

Accordia Golf

-

Davey Golf

-

IGM

-

Elite Golf Management

-

Cypress Golf Course Services

-

NBC Sports Next

-

Western Golf Properties

Major Developments

-

Arcis Golfacquired a large multi-course facility in Texas in early 2025. The deal included a significant capital reinvestment plan to modernize the club and expand services.

-

KemperSportsannounced the addition of several private clubs to its portfolio in 2024, focusing on premium hospitality offerings and customer experience.

-

Troonexpanded its footprint in international markets with new contracts for management services in South America and Southeast Asia.

-

NBC Sports Nextintegrated new digital booking tools and launched an AI-based customer insight platform to support smarter service delivery.

-

Elite Golf Managemententered into a joint venture with a property developer in the Middle East to operate golf clubs as part of high-end residential communities.

Conclusion

The golf course operation service market is on an upward trajectory, fueled by innovation, sustainability, and shifting player demographics. Despite challenges like high costs and labor issues, there is significant potential for operators who invest in tech-driven, eco-conscious, and customer-centric strategies. As golf evolves beyond its traditional roots, service providers that adapt to modern expectations will stand to gain the most in the coming years.

Frequently Asked Questions (FAQs)

Q1. What is the expected growth of the golf course operation service market?

The market is expected to grow from USD 2428 billion in 2024 to approximately USD 36 billion by 203032.

Q2. What trends are currently shaping this market?

Technology adoption, sustainability, hybrid golf-entertainment formats, and digital customer experiences are key trends.

Q3. What are the major challenges in the industry?

High operational costs, labor shortages, and environmental regulations are the main challenges.

Q4. Who are the top players in the market?

Major operators include Troon, KemperSports, Arcis Golf, Accordia Golf, and NBC Sports Next.

Q5. What regions are expected to see the most growth?

Asia-Pacific, Latin America, and parts of the Middle East are expected to experience the fastest growth due to rising demand and new infrastructure.